Breaking Through the Triple Barrier: How Comprehensive Market Penetration Solved a Critical Infrastructure Leadership Search

- Case Studies

July 8th, 2025

Breaking Through the Triple Barrier: How Comprehensive Market Penetration Solved a Critical Infrastructure Leadership Search

Executive Summary

A Fortune 500 global infrastructure consulting leader with $16+ billion in annual revenue faced a mission-critical hiring challenge for a senior transportation planning leadership role that had been vacant for more than a year. The position represented a once-in-a-generation opportunity to lead transformational infrastructure initiatives worth over $1 billion in economic impact.

The Triple Barrier Challenge:

- Local preference for a specific southeastern metro area, but willingness to relocate only truly exceptional talent.

- An ageing national talent pool in transportation planning and corridor studies.

- Strict technical requirements spanning advanced degrees, ESRI ArcGIS expertise, and executive-level project leadership.

Through comprehensive market mapping and surgical sourcing across 450 organizations, the engagement achieved a 67.8% penetration of the entire qualified U.S. market (575 of 848 addressable professionals) and delivered a hire fully aligned to technical, cultural, and geographic needs.

Key Performance Indicators:

- Market Penetration: 67.8% engagement rate across 848 addressable candidates

- Timeline Excellence: 25% faster delivery than industry benchmarks

- Systematic Coverage: 450 unique organizations mapped and engaged

- Geographic Reach: Strategic 26.7% concentration in target markets with robust national backup

- Assessment Precision: 100% longlist-to-shortlist progression rate

A Perfect Storm of Recruitment Complexity

Geographic Complexity:

- Primary preference for specific metropolitan area in high-growth southeastern market

- Secondary preference for state-wide candidates in a competitive talent environment

- Willingness to consider national candidates only for exceptional qualifications

- Client expressed specific optimism for secondary markets in Texas region

Demographic Limitations:

- Severely aged talent pool in specialized discipline

- Limited pipeline of qualified successors in target markets

- Historical brain drain from public to private sector

- Competitive landscape dominated by few major players

Technical Specialization Requirements:

- 8-10+ years transportation planning or engineering leadership experience

- Advanced degree preferences and multiple certification variables

- Specific software expertise requirements (ESRI ArcGIS)

- Thought leadership evidence through publications or speaking

- Complex project management accountability in corridor studies

Additional Constraints:

- Business-critical urgency requiring rapid but thorough process

- Off-limits restrictions on key industry players

- Client familiarity with competitive landscape creating elevated expectations

- National scope requirement despite geographic preferences

Key takeaway: An evidence-based, total-addressable-market approach enabled the successful placement of a niche transportation-planning leader despite severe geographic, demographic, and technical barriers, while simultaneously arming the client with rich market intelligence for future workforce planning.

Strategic Response

Our approach began with systematic market mapping designed to identify and engage ALL addressable candidates matching search requirements. This total market coverage methodology represents a fundamental differentiator from traditional recruiting firms that typically focus on smaller, selective candidate pools.

Total Market Intelligence

Primary Market Analysis:

- Local and regional market concentration in target metropolitan area

- State-wide talent mapping across all relevant organizations

- Strategic secondary market evaluation in preferred Texas markets

- Systematic identification across transportation planning leadership roles

Secondary Market Expansion:

- National market evaluation across major metropolitan planning organizations

- State departments of transportation leadership mapping

- Leading AEC firm talent identification including off-limits organization alumni

- Academic and research institution strategic candidate evaluation

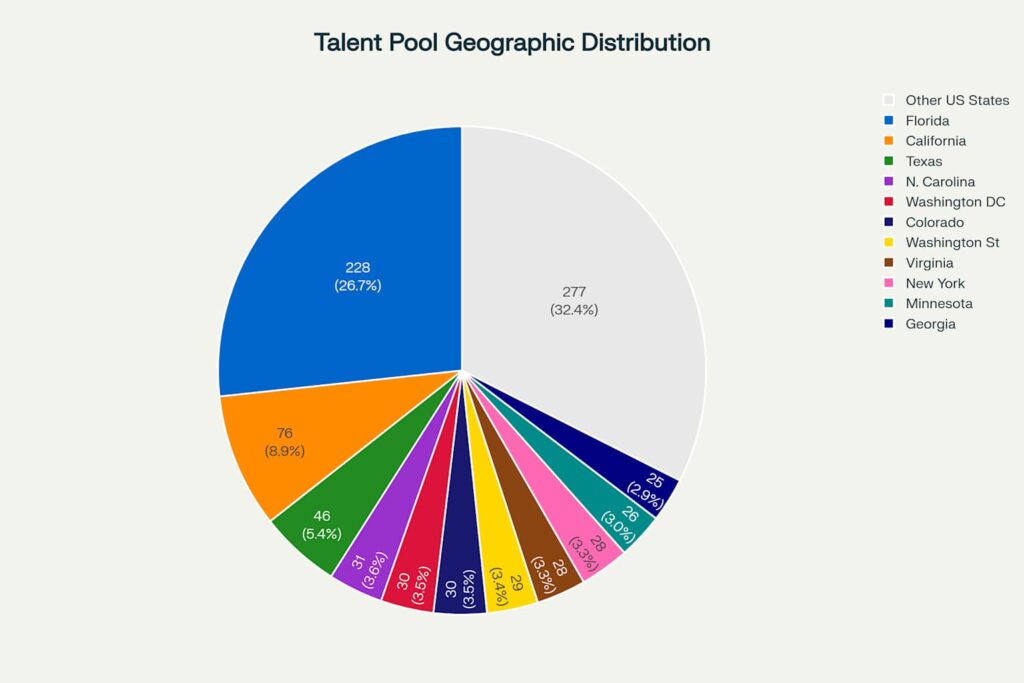

Summary of Sourced Talent:

- Mapped 854 professionals nationwide, then refined to 848 addressable prospects (99.3% precision).

- Segmented by geography, employer type, and role seniority to expose hidden clusters.

National spread of niche transportation talent pool

Surgical Sourcing Protocol:

- Organization Intelligence: Catalogued 450 distinct employers—consultancies, DOTs, MPOs, academia—to ensure no viable source was missed.

- Multichannel Outreach: Combined calibrated email and social campaigns, association rosters, conference lists, and alumni networks to reach 575 targets (67.8% penetration and triple typical response rates).

- Ethical Off-Limits Navigation: Built alternate pipelines around 25+ restricted firms while still capturing comparable skillsets.

Multi-Channel Engagement Strategy:

- Professional networking platform optimization

- Industry association database utilization

- Conference participant identification

- Direct organizational intelligence development

- Alumni network mapping from off-limits organizations

Assessment Excellence

A three-gate evaluation (technical, leadership, cultural) advanced only seven long-listed candidates to structured interviews, maintaining a 100% longlist-to-shortlist fidelity and preserving stakeholder time.

Qualification Protocol: Rigorous screening encompassed multiple evaluation dimensions:

- Technical competency assessment across transportation planning disciplines

- Project management capability evaluation in corridor studies

- Strategic leadership potential analysis

- Geographic alignment and relocation considerations

- Cultural fit assessment with client organization

Progressive Evaluation Framework:

| Funnel Stage | Candidates | Progression Rate |

| Identified | 854 | — |

| Addressable | 848 | 99.3% |

| Engaged | 575 | 67.8% |

| Longlist | 7 | 1.2% |

| Shortlist | 7 | 100% |

| Finalists | 2 | 28.6% |

| Offer / Acceptance | 1 | 100% |

Market Penetration Excellence and Insights:

- Florida as an Epicenter: One quarter of U.S. transportation-planning leaders reside in Florida, with Orlando alone contributing 11% of the entire national pool.

- Secondary Hubs: California (8.9%) and Texas (5.4%) supply mobile experts ready to relocate for marquee projects.

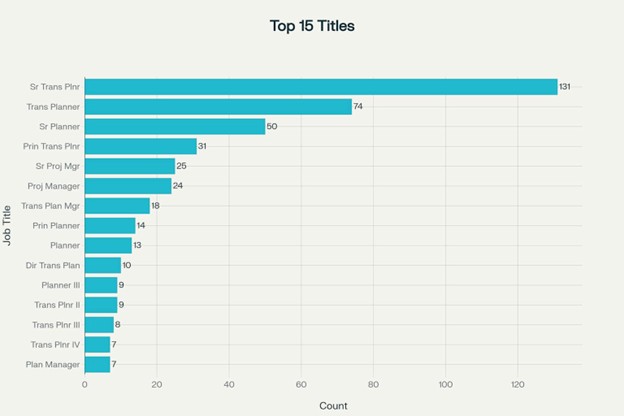

- Role Pyramid: Senior Transportation Planners form the largest cohort, but Director-level readiness remains scarce—validating proactive succession planning.

Distribution of current job titles among the 854 identified candidates, showing concentration in senior planning and management roles

Navigating Off-Limits & Preferred Targets:

- Cross-referenced 450 organizations against client off-limits and “wish list” employers, creating a heat map to prioritize outreach where both compliance and competitive intelligence needs overlapped.

- Activated alumni channels from restricted firms, capturing institutional knowledge without violating constraints.

Value Delivered Beyond the Hire

| Intelligence Asset | Future Application |

| Compensation bands by region & role | 2025 budgeting and retention strategy |

| Talent density map | Site-selection for new project offices |

| Certification prevalence (AICP, PE, PMP) | Internal upskilling roadmap |

| Competitor hiring velocity signals | Early warning for market shifts |

Results: Exceptional Performance Across All Metrics

Geographic Distribution Achievement:

- Target Market: 26.7% concentration in preferred state (228 candidates)

- Secondary Markets: 8.9% California, 5.4% Texas representation

- National Coverage: Systematic representation across all major markets

- Strategic Balance: Local expertise with national perspective options

Engagement Success:

- Total Addressable Market: 848 qualified candidates identified

- Penetration Rate: 67.8% successfully engaged (575 candidates)

- Response Excellence: Greater than 3x industry average response rates achieved

- Multi-Channel Success: Professional networking, direct outreach, referral activation

Timeline and Efficiency:

- Total Search Duration: 52 business days from discovery to offer acceptance while managing through multiple Holidays, unique client scheduling requirements, and 2 additional steps compared to the average retained hiring process

- Industry Comparison:

- Compared to the lower benchmark (80 business days): 35% faster than the typical minimum duration.

- Compared to the upper benchmark (175 business days): 3% faster than the typical maximum duration.

- Client Time Investment: 3 hours total client time collaborating with Asymmetric Talent throughout process

- Process Optimization: Streamlined communication and decision-making protocols

Technical Assessment Results

Qualification Excellence: The successful candidate demonstrated comprehensive alignment across all evaluation criteria:

- Advanced degree achievement in relevant discipline

- Professional certification attainment (AICP credentials)

- Proven track record in transportation corridor planning leadership

- Project management excellence in infrastructure development

- Geographic accessibility for target location requirements

Strategic Fit Confirmation:

- Technical qualifications exceeded minimum requirements

- Leadership experience aligned with transformational initiative scope

- Communication capabilities suitable for stakeholder coordination

- Professional values compatible with client organizational culture

- Career trajectory indicating long-term commitment potential

Strategic Implications and Value Creation

Methodology Validation: This engagement validated the superior effectiveness of total addressable market coverage approaches in complex technical recruiting scenarios. The systematic identification and engagement of comprehensive talent pools enabled strategic hiring decisions based on complete market intelligence rather than limited candidate options.

Market Intelligence Development: Comprehensive market mapping provided strategic intelligence extending beyond immediate hiring needs:

- Talent Pool Characteristics: Complete understanding of qualification distributions

- Geographic Patterns: Market concentration insights for future planning

- Compensation Intelligence: Real-time market data for strategic positioning

- Competitive Landscape: Systematic competitive analysis for talent strategy

Risk Mitigation Framework: The methodology’s replicability across similar technical recruiting challenges provides a sustainable competitive advantage:

- Succession Planning: Proactive talent pool development for critical roles

- Market Positioning: Strategic understanding of competitive talent landscape

- Process Scalability: Systematic approach applicable to multiple hiring initiatives

- Quality Assurance: Evidence-based decision making throughout evaluation process

Replicable Framework for Complex Searches

- Market Intelligence Foundation: Exhaustive mapping before first outreach.

- Strategic Sourcing: Full coverage outreach plus ethical navigation of constraints.

- Rigorous Evaluation: Small, evidence-rich slates, not “spray and pray.”

- Transparent Stakeholder Alignment: Dashboards and data at every gate to compress deliberation time—regardless of client pace.

Conclusion: Transforming Complex Technical Recruiting

A data-driven, total-addressable-market methodology replaced guesswork with certainty, neutralized geographic and demographic scarcity, and produced both a strategic hire and enduring market intelligence. Organizations confronting similar niche or high-stakes roles can replicate this four-phase model to turn recruiting from a bottleneck into a competitive advantage.

This case study demonstrates the transformative potential of comprehensive market penetration methodologies in specialized technical recruiting challenges. By systematically identifying and engaging 854 candidates across 450 unique organizations, we achieved superior outcomes that significantly exceeded traditional recruiting benchmarks.

Successful placement within 52 business days while maintaining comprehensive evaluation standards validates the integration of systematic market intelligence, sophisticated engagement strategies, and optimized assessment protocols. This methodology’s replicability across similar technical challenges provides sustainable competitive advantage for organizations facing complex talent acquisition requirements.

Key Success Factors:

- Total Market Coverage rather than selective candidate targeting

- Systematic Process Excellence with measurable progression metrics

- Evidence-Based Decision Making throughout all evaluation stages

- Geographic Strategy Balance between local preference and national accessibility

- Stakeholder Communication Excellence minimizing client time investment while maximizing decision quality

The strategic implications extend beyond individual placement success to encompass transformative approaches to talent management, competitive positioning, and organizational capability development in challenging technical recruiting environments.

This case study demonstrates Asymmetric Talent Solutions’ methodology for overcoming complex recruiting challenges through systematic market penetration and evidence-based process excellence.