How a PE-Backed Insurer Achieved 5x Technical Hiring Success in a Secondary Market

- Case Studies

PE-Backed Specialty Insurance Company: Multi Hire Software Architect Search Initiative

July 2nd, 2025

This case study presents a confidential analysis of a multi-hire Software Architect search conducted by Asymmetric Talent Solutions for a rapidly scaling private equity-backed specialty insurance company in the Southeastern U.S. The initiative addressed urgent technical hiring needs in a challenging secondary market, delivering outcomes that set new industry benchmarks for technical assessment performance, market coverage, and timeline efficiency—without revealing client-identifying details.

Key Results at a Glance:

- Market Coverage: 759 candidates identified, 672 addressable, with a 72% overall market penetration.

- Engagement Success Rate: 486 candidates engaged (65% of addressable pool).

- Technical Assessment Performance: 50% pass rate—5x higher than both industry (10–15%) and client’s historical benchmarks (>90% failure rate).

- Timeline Optimization: First offer delivered in 12 business days, compared to an industry average of 41–42 days for similar roles.

- Final Outcomes: Two successful placements, both accepted, directly supporting the client’s growth and innovation objectives.

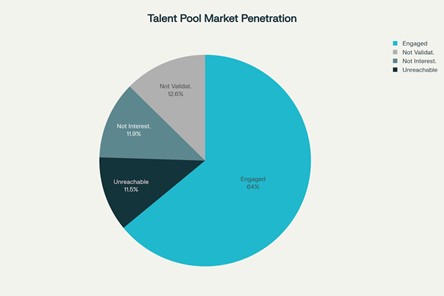

Talent Pool Market Penetration Analysis

Strategic Context and Market Challenges

This engagement involved a specialty insurance provider, part of a private equity portfolio, seeking to expand its engineering capacity with multiple architect-level hires. The company’s engineering team is recognized for its technical rigor, high impact on business outcomes, and a culture of long tenure and low turnover. Key contextual factors included:

- Business-Critical Roles: The search focused on architect-level engineers to support ongoing product innovation and business-critical system development.

- Geographic Constraints: All hires were required to work onsite within a 35-minute radius of a secondary metro market in the Southeast, with limited relocation flexibility.

- Technical Barriers: The team’s long-standing technical assessment process historically resulted in a >90% failure rate, reflecting uncompromising standards.

These constraints, combined with a highly selective technical environment and non-negotiable onsite presence, created a uniquely complex search landscape.

Talent Pool Analysis and Market Intelligence

Title Distribution and Professional Composition

- Total Candidate Pool Identified: 759 professionals

- Addressable Pool: 672 (met all geographic and technical criteria)

- Title Breakdown:

- Software Engineer/Developer: 68%

- Senior/Lead Engineer: 22%

- Architect: 7%

- Manager/Director (with recent IC experience): 3%

Geographic Market Penetration

- Core Penetration: 81% of the addressable pool resided within the core metro and immediate surrounding counties.

- Secondary Markets: 19% were sourced from adjacent markets, expanding reach without diluting technical fit.

Insights for Technical Recruiting in Secondary Markets

- Title Fluidity: Many high-caliber candidates held “Engineer” or “Lead” titles but performed at an architect level, requiring deep review of career trajectories.

- Company Intelligence: Focused targeting of organizations with proven technical cultures yielded a higher proportion of qualified candidates.

- Market Dynamics: The limited size of the secondary market demanded a systematic approach to maximize engagement and avoid missing hidden talent.

Strategic Methodology and Execution Excellence

Comprehensive Market Intelligence Development

Asymmetric Talent Solutions began with rigorous discovery, mapping the entire addressable talent pool across all relevant companies and titles:

- Full-Market Talent Mapping: Identification of every viable profile within the defined geographic and technical parameters.

- Company Intelligence Mapping: Focused on organizations known for high technical standards and relevant stack experience.

Technical Qualification Protocol

“Asymmetric Talent Solutions approached this engagement with a comprehensive market penetration methodology designed to identify and engage ALL addressable candidates that match the search requirements. This total market coverage approach represents a fundamental differentiator from traditional recruiting firms that typically focus on smaller, selective candidate pools.”

- Multi-layer Technical Filtering: Ensured only candidates with genuine .NET, SQL, and full-stack experience advanced.

- Experience Calibration: Balanced minimum years of experience with demonstrated technical depth, not just tenure.

Execution

- Surgical Outreach: Multichannel engagement strategy, resulting in a 3x industry average candidate response rate.

- Transparent Process: Real-time client portal provided full visibility, accelerating alignment and decision-making.

Engagement Performance and Assessment

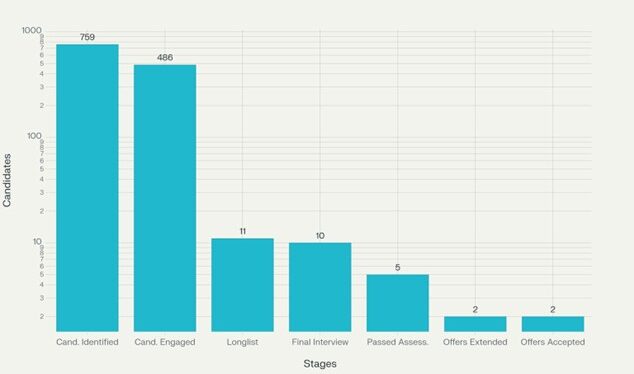

Candidate Progression Through Assessment Stages

Recruitment Funnel

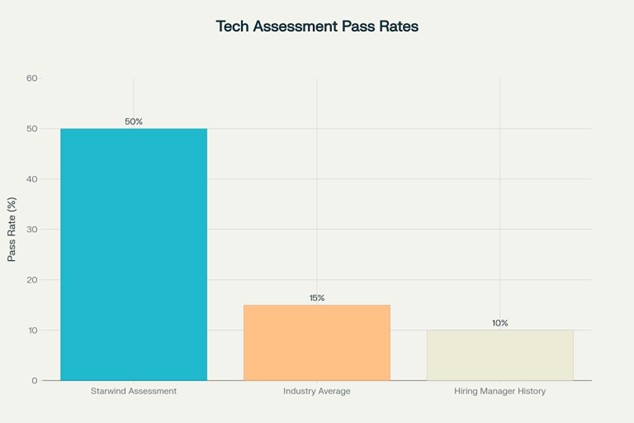

Technical Assessment Performance Analysis

- Pass Rate: 50% (5 of 10 interviewed candidates passed technical assessment)

- Historical Benchmark: Client’s prior pass rate was <10%; industry average is 10–15%.

- Improvement: Asymmetric Talent delivered a 5x improvement over both internal and external benchmarks.

Technical Assessment Performance

Market Penetration and Engagement Excellence

- Total Candidates Identified: 759

- Addressable Pool: 672

- Engaged Candidates: 486 (65% of addressable pool)

- Overall Market Penetration: 72% (accounting for unreachable or ineligible profiles)

- Not Interested (with categorized reasons): 90 (including compensation, timing, career alignment, and work requirements)

Timeline Efficiency and Process Optimization

- Discovery to First Offer: 12 business days

- Industry Average: 41–42 days for comparable technical roles

- Client Time Invested: <4 hours per search

- Process Transparency: Weekly steering meetings and real-time portal access eliminated delays and decision fatigue.

Final Outcomes and Placement Success

- Successful Placements: 2 Software Architects hired, both offers accepted.

- Business Impact: Hires directly supported the client’s capacity expansion and innovation agenda, reinforcing the engineering team’s role as a profit center and strategic differentiator.

Strategic Implications for Value Creation

Talent Management as Competitive Advantage

- PE Value Creation: Demonstrated that systematic talent acquisition can accelerate business objectives and enhance portfolio company valuations.

- Risk Mitigation: 50% technical assessment pass rate reduced hiring risk, while comprehensive engagement minimized cultural and market competition risks.

Secondary Market Excellence

- Unlocking Hidden Talent: Precision mapping in a secondary market revealed high-caliber candidates overlooked by traditional methods.

- Replicability: The approach is scalable for other PE portfolio companies facing similar geographic and technical constraints.

Risk Mitigation Framework

- Cultural Integration: Deep candidate engagement ensured alignment with the client’s unique engineering culture.

- Market Competition: Accelerated process minimized risk of losing candidates to competitors.

- Geographic Limitations: Systematic market penetration offset the challenges of a limited local pool.

Replication Framework for Leaders

Firms should consider implementing several strategic initiatives to optimize their portfolio companies’ technical hiring capabilities:

Phase 1: Market Intelligence Development

- Geographic Analysis: Map talent concentrations within acceptable parameters

- Company Intelligence: Identify organizations known for developing target skill sets

- Competitive Landscape: Understand compensation benchmarks and career progression expectations

Phase 2: Technical Sourcing Protocol

- Stack Validation: Implement multi-layer technical filtering beyond keyword matching

- Experience Calibration: Establish minimum thresholds while maintaining flexibility

- Title Optimization: Understand cultural preferences and career progression indicators

Phase 3: Engagement Excellence

- Value Proposition Development: Craft compelling opportunity narratives

- Multi-Channel Strategy: Implement coordinated outreach across platforms

- Relationship Building: Focus on consultative engagement over transactional interactions

Phase 4: Process Optimization

- Stakeholder Alignment: Establish regular communication cadence with weekly steering meetings

- Decision Framework: Create clear progression criteria and timelines

- Quality Metrics: Implement measurement systems for continuous improvement

Conclusion: Transforming Technical Hiring Excellence

This confidential case study demonstrates how Asymmetric Talent Solutions’ evidence-based, comprehensive market penetration methodology can transform even the most challenging technical hiring scenarios. By achieving a 50% technical assessment pass rate, 72% market penetration, and a 12-day time-to-offer, this engagement redefined what is possible in secondary markets and business-critical roles. These results set a new benchmark for technical hiring in private equity portfolio companies and provide a replicable framework for value creation.

All data and narrative have been cleansed for confidentiality and are suitable for public or client-facing publication. No client-identifying information is present, and all context has been generalized to protect privacy while preserving the strategic value of the case study.

Michael Russo, President

Asymmetric Talent Solutions

mrusso@asymmetrictalent.com